August 7th, 2023. Private: Andrew Hosford

EPC Requirements on Commercial Properties

In this piece, we’re going to look at the current state of EPC ratings on commercial properties in the UK, what the future looks like, and offer a solution for developers and investors going forward.

Definition

Firstly, for those who don’t know and those who require a recap – what are energy performance certificates (or EPCs)?

You’ve probably noticed a multi-coloured sticker on your new appliances at home highlighting its energy performance, and now, buildings are given a similar certification – it ranges from A, the most efficient, to G, the least.

These certificates reveal the anticipated heating and lighting costs of the property, along with its estimated carbon dioxide emissions.

Beyond the initial insights, an EPC goes the extra mile by providing valuable data on potential improvements that could boost the energy efficiency rating, while also suggesting cost-effective strategies to achieve a better standing.

Even tenants can partake in enhancing energy efficiency by implementing some of the EPC’s recommendations, such as adopting more energy-efficient light bulbs.

Your EPC is valid from 10 years after the date first issued.

Regulations

As of April 2023, all commercial buildings must achieve an absolute minimum of EPC rating of ‘E’, even if there is no change of tenant.

In fact, it is now unlawful for a landlord to let out a commercial property with a rating of ‘F’ or ‘G’.

˅

In April 2025, all buildings must have their EPC ratings lodged.

˅

From April 2027, all properties will have to achieve a minimum EPC rating of ‘C’ in order to receive further rent or accept any new lettings.

˅

Any by April 2030, the minimum requirement for further rent and new tenants rises to a rating of ‘B’.

We actually think some of these regulation targets are a little conservative. For example, why not set a target for all commercial units to be passable with a ‘D’ rating by April 2024, as there are no further incentives required until 2027? And as for aiming for an EPC rating of ‘B’ by 2030, why not raise the bar and go for ‘A’?

Effect

Along with:

- Changes to the occupational market

- Agile working and changing working practices

- Higher base rates

- Contagion from the US banking crisis

- Refinancing outcomes and lender attitudes

The UK’s transition to green is one of the key factors cited to cause further price volatility in the market.

A glimpse into the affect this could have on UK landlords makes for stark reading.

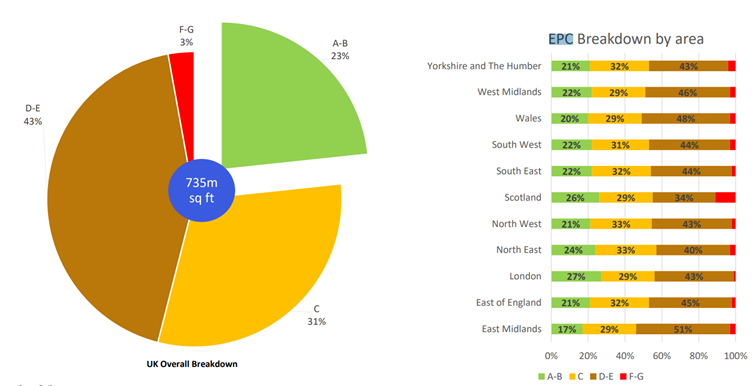

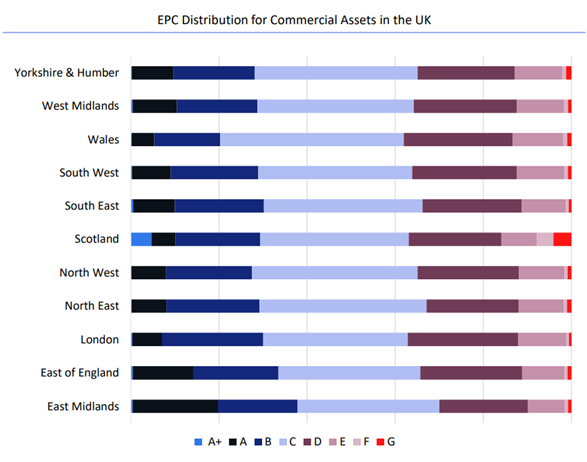

EPC Distribution for Office Spaces in the UK

(source: Savills Data & Insight)

London has the highest % of A-B rated offices in the UK, but finds itself in joint last position for grade ‘C’. That leads us to believe that the large number of new builds in the capital are contributing to the 27% of A ratings, thus showing developers are taking EPC ratings seriously and want a greener UK.

The question then becomes, what can the government do to fast-track the ‘C’ rated properties to improve London’s output?

How to Improve your EPC Ratings

Fortunately, commercial landlords have numerous options at their disposal to enhance their EPC ratings and boost energy efficiency. Improving a property’s energy efficiency can significantly enhance its rating, and a good starting point is focusing on insulation.

Inadequate insulation can lead to significant energy loss, particularly in large commercial spaces like warehouses with extensive roof and wall surface areas. Remedying this can involve upgrading cladding or conducting refurbishment works, which may require an initial investment but should result in lower energy bills over time.

Further upgrades include improved heating, ventilation, and air conditioning systems, upgrading to energy-efficient lighting, improving glazing, and investing in solar panels. Although these upgrades may necessitate thorough planning, investors can find support to shoulder the burden.

For investors uncertain about the minimum EPC rating requirements for commercial properties or the next steps to take, public entities are available to offer guidance. The Carbon Trust provides independent advice on efficient energy usage for businesses and the integration of renewable energy sources. The Energy Savings Trust showcases exemplary case studies of best practices, alongside other energy efficiency resources and events.

In addition, the Government offers various schemes that extend loans, grants, or subsidized energy-saving initiatives to support small businesses. For instance, the Low Carbon Workspaces scheme recently granted up to £5,000 to small businesses for implementing energy efficiency measures, while the Business Energy Efficiency Programme provided similar grants of up to £20,000.

Whilst this is, of course, a start, a grant of £5,000 for a small business isn’t going to make a huge dent in the costs needed to improve EPC ratings at the rate required.

Conclusion

Upgrading buildings will inevitably incur costs for landlords, but this could be offset by the potential benefits of attracting more tenants and increasing the property’s capital value.

In response to this financial burden, landlords might consider transferring some of the costs to tenants, especially in lease renewal scenarios where tenants are not vacating and thereby limiting the landlord’s ability to conduct renovations. In such cases, a collaborative approach between landlords and tenants may be necessary, as ultimately, tenants stand to gain from reduced building running costs.

At Pure Structured Finance, as well as providing funding for purchasing commercial properties, we can also access a number of different refurbishment products to help you upgrade your premises.

Call us on 02080 579 178 or request a callback here.

Article By Private: Andrew Hosford

August 7th, 2023

Andrew is a Director within Pure Structured Finance and a founding member of the company.

He previously spent a decade with a real estate advisory firm before launching Pure Structured Finance. He is highly experienced in arranging senior debt, mezzanine and equity finance for property investors and developers across all asset classes. His key focus is building long term relationships with clients, with a view to working closely with them and facilitating all their property funding needs.

Andrew is an established member of the finance community sitting on multiple boards including FIBA and is a regular panellist for various property awards committees.

Email: andrew@purestructuredfinance.co.uk

Follow Andrew on LinkedIn here

See more articles by Private: