July 30th, 2021. Tom Lee

Real Estate Investment and Development: What Is the Capital Stack?

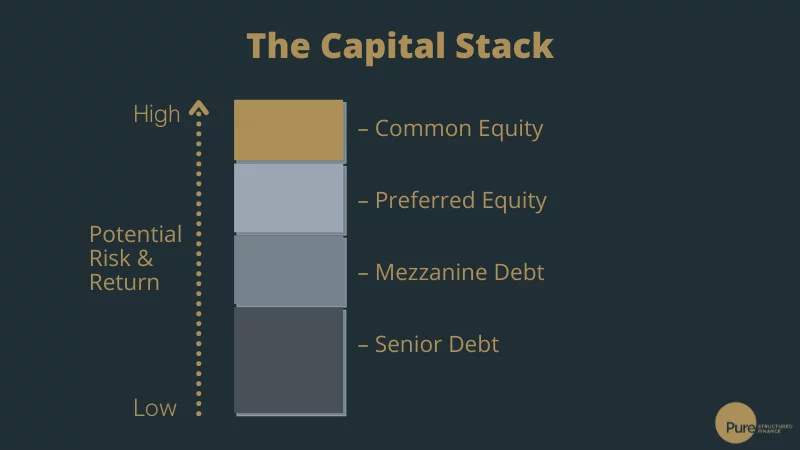

There are many different ways to invest in real estate, from owning rental properties to property development. However, with every type of property investment, it is vital you carefully consider the potential risk and reward. One important term you will hear in relation to this risk assessment is the “capital stack”. So, what is the capital stack, how can understanding it protect your investment, and which pieces of it do you require? Here, we discuss the concept in detail.

What Is the “Capital Stack”?

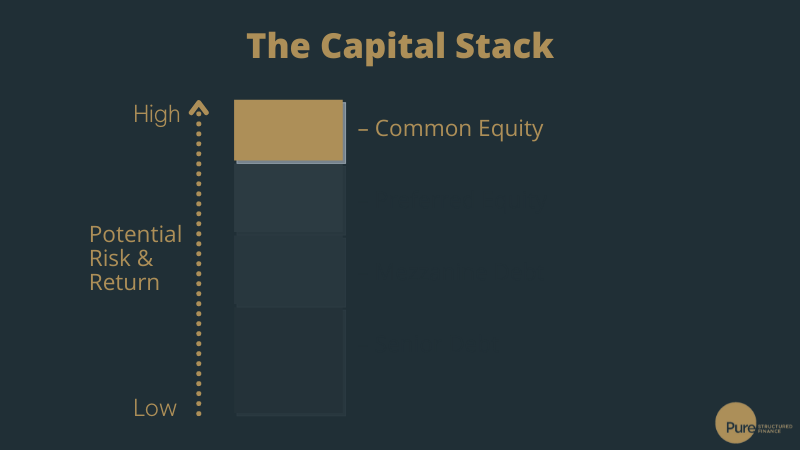

Real estate investment requires multiple layers of funding. The real estate capital stack is an explanation of how these layers are ordered. By looking at the capital stack, you can better understand the potential risk and return of your investment and make a more informed choice.

The upper-most layer of the capital stack, common equity investment is seen as high-risk and high-reward.

The clear risk with this kind of investment is that repayments are prioritised for all other investments first, so if investments fail to perform you may risk losing some, or all, of your initial investment. Additionally, with common equity, there is no recorded interest against the property and lenders are not typically entitled to regular repayments. As a common equity investor, your payment is only received either when the property is sold, or if there is a liquidity event.

Though the risks are high, the potential returns for common equity investment can be significantly higher than for lower levels in the capital stack. Part of the reason behind this is that potential returns typically aren’t capped for common equity investors.

Senior Debt

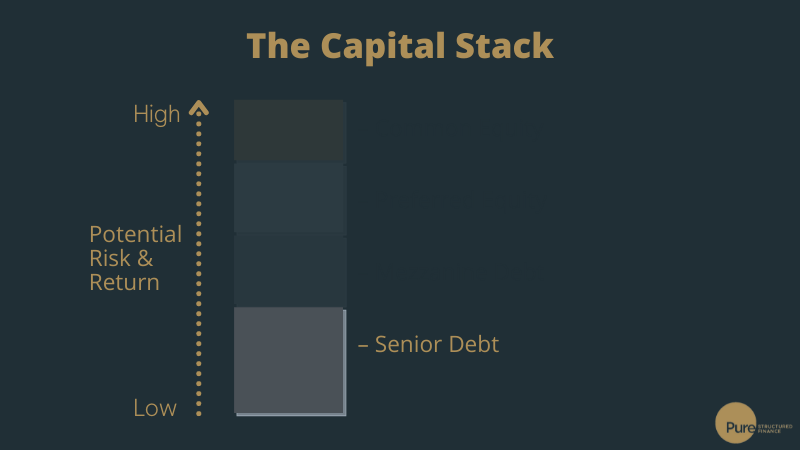

The foundational bed of the capital stack, senior debt is the largest and least costly layer of real estate investment.

Senior debt is secured by a mortgage or a deed of trust against the property. As a result, if the borrower fails to pay and defaults on the loan, the lender is entitled to claim the title of the property. This makes senior debt the lowest-risk option for property investment.

As senior debt , you are not entitled to a portion of the return if the venture is profitable. Instead, the return you can expect to receive is the rate that has been negotiated and stated in the loan documents. Therefore, your returns will be lower than those of investors at higher levels of the capital stack.

Mezzanine Debt

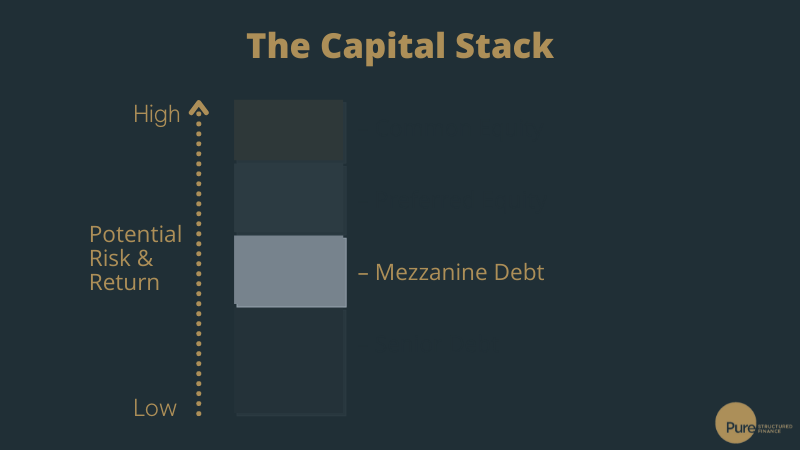

Mezzanine debt sits above senior debt in the capital stack, meaning it is the next highest priority for payment. Like senior debt investors, mezzanine lenders are entitled to regular payments regardless of how the investment performs.

Mezzanine lenders also have some foreclosure rights, though these are limited as there is no recorded interest in the property itself. So, these lenders can take control of the property if the borrower is unable to pay – provided they aren’t in default under the senior debt. Typically, in this case, the senior debt and mezzanine lenders will enter into an inter-creditor agreement.

Mezzanine debt can be an attractive option as it typically has a higher rate of return than senior debt, with less risk than the higher levels of the capital stack.

Preferred Equity

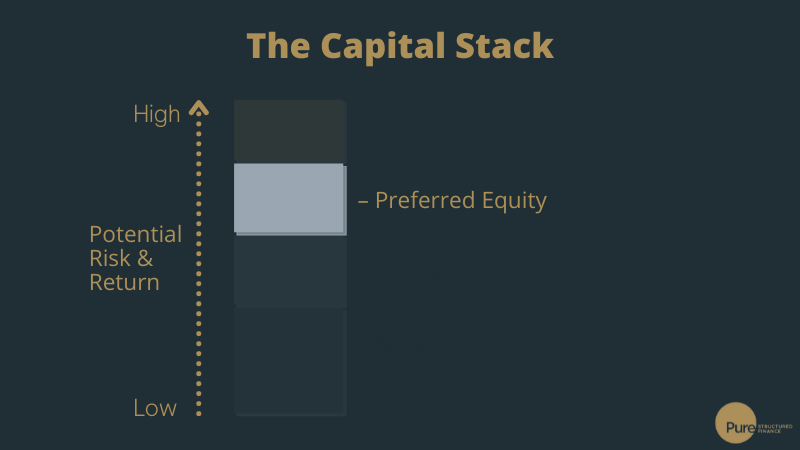

Sitting between mezzanine debt and common equity, preferred equity is highly flexible and can vary greatly. However, one important feature of preferred equity is that it entails a preferred rate of return that must be paid. This affords lenders/investors a greater level of security than with common equity.

Preferred equity shares feature with both mezzanine debt and common equity. For example, lenders may have a right to regular recurring payments in the same way mezzanine lenders do. Plus, they will typically share in the profits of the investment – though to a lesser degree than with common equity.

Preferred equity investments are often described as either “hard” or “soft”. A “hard” preferred equity investment normally stipulates the preferred return must be paid regardless of how the investment performs, or what the final profits are within a development. Contingencies are planned for, and it is therefore seen as less risky. Meanwhile, “soft” preferred equity investment typically requires payments to be made only if there is sufficient cash flow.

Common Equity

The upper-most layer of the capital stack, common equity investment is seen as high-risk and high-reward.

The clear risk with this kind of investment is that repayments are prioritised for all other investments first, so if investments fail to perform you may risk losing some, or all, of your initial investment. Additionally, with common equity, there is no recorded interest against the property and lenders are not typically entitled to regular repayments. As a common equity investor, your payment is only received either when the property is sold, or if there is a liquidity event.

Though the risks are high, the potential returns for common equity investment can be significantly higher than for lower levels in the capital stack. Part of the reason behind this is that potential returns typically aren’t capped for common equity investors.

Choosing a Position in the Capital Stack

Your preferred position in the capital stack and also which aspects you need or want to raise will depend on numerous factors, from your risk appetite to your broader portfolio strategy and the details of the property itself.

Risk-adverse investors and lenders may find security in the lower levels of the capital stack, such as senior debt, which provide stronger assurances any investment will be repaid. The lower potential reward to these types of investment may be sufficiently attractive given the level of security here.

Meanwhile, for those who are more risk-tolerant investors, the potential profits from the equity layers may be more appealing.

In any case, understanding the capital stack is a key cornerstone to protecting and growing your investment portfolio. With this knowledge, you can understand your level of risk, and decide whether you want to work with outside parties to fill different layers of the capital stack.

Finance Unique to Your Investment

Here at Pure Structured Finance, tailoring finance for unique projects is our speciality. We advise and structure all layers of funding from senior and mezzanine debt to equity. So, if you are looking to raise any type of capital for either a development project or a commercial investment, trust our experienced team to secure the funding you need.

Call us today on 02080 579 178, or request a callback.

Article By Tom Lee

July 30th, 2021

Tom is one of the founding members of the company and has been a part of the Pure Group since 2013 playing an integral part of the business’s growth and direction.

He had over 10 years of experience in the real estate financial sector prior to joining Pure with a major bank. Tom has a wealth of experience providing debt advisory on large, complex deal structures for developers and investors across all asset classes, throughout the UK and parts of Europe.

He has built a strong network across the property and finance sector, which enables him to provide a total package solution to his clients and contacts, with whom he has built long standing relationships.

Email: tom@purestructuredfinance.co.uk

Follow Tom on LinkedIn here.

See more articles by Tom