October 21st, 2025.

UK Budget 2025: Property and Financial Market Impacts

Budget 2025 Expectations and Overview

The upcoming UK Budget 2025 is highly anticipated, especially for its potential impact on the property market and broader financial conditions. Early previews suggest the government may introduce radical changes to property taxation as part of a push to modernize the housing market and fill a sizeable fiscal gap. Chancellor Rachel Reeves has repeatedly signalled she won’t raise income tax, NI, or VAT, which puts property and wealth taxes in focus for raising revenue. As a result, experts and industry watchers are bracing for major housing-related measures, from possible stamp duty reforms to new taxes targeting high-value homes. This confluence of expected policies could have far-reaching effects on house prices, buyer behaviour, and investment decisions in 2025.

Stamp Duty Overhaul and Property Taxes

One headline expectation is an overhaul of Stamp Duty Land Tax (SDLT). Reports indicate the Treasury is considering replacing stamp duty with a new proportional property tax on high-value home sales. Under this plan, homes sold for over £500,000 would incur a tax based on value, while most ordinary transactions would pay no SDLT. (For context, the average UK house price is about £269,000, so roughly 80% of sales could become tax-free under such a scheme.) This change aims to eliminate what economists deem a highly inefficient tax: SDLT “stops people moving house” and reduces labour mobility, leading to misallocation of housing. Cutting or abolishing stamp duty on main residences could therefore boost property transactions, as buyers and sellers no longer feel “trapped” by a hefty tax bill. However, history shows caution: past stamp duty holidays mostly pulled transactions forward without increasing long-term demand – and sellers often captured the benefit via higher prices. In other words, a tax cut might spur a short-term sales surge and modest price uptick, but the main winners can be sellers if home values adjust upward accordingly.

Alongside SDLT changes, other property tax tweaks are on the table. One rumour is a “mansion tax” via capital gains – potentially ending the full CGT exemption on very expensive primary residences. If introduced, owners of high-end homes could face tax on sale profits above a threshold, which might deter some sales and cool the top end of the market. There’s also talk of council tax reform, given the widely acknowledged unfairness of outdated council tax bands (which currently “dramatically under-tax” expensive properties). A revaluation or a new annual property levy could shift more burden to high-value homes, while easing it on cheaper properties. All these changes carry trade-offs. They promise a fairer, more efficient system long-term – for example, eliminating SDLT could remove a big barrier to moving, and a reformed property tax regime could align taxation with real home values. But they also pose risks: high-end markets (mostly London and the South East) might stagnate if extra taxes bite, and the government must replace lost SDLT revenue (~£10 billion a year) through these new measures. The Budget will need to strike a balance so that encouraging mobility and homeownership doesn’t inadvertently dent confidence at the upper end or dissuade investment in housing.

Housing Market Outlook: Prices and Sales

Despite recent economic headwinds, the housing market in late 2024/25 has been resilient but muted. Annual house price growth has slowed to low single digits – around +2–4% year-on-year according to most indices. This modest growth reflects the tug-of-war between still-elevated mortgage rates and improved supply of homes for sale. Looking ahead, analysts generally foresee a gentle uptick in prices for 2025, assuming interest rates ease and Budget measures bolster confidence. The Home Owners Alliance reports expert 2025 house price predictions ranging from ~1% up to 4% growth, with consensus clustering around low single-digit rises. Factors supporting this outlook include stronger income growth, slightly lower borrowing costs, and returning buyer confidence – tempered by plenty of homes on the market, which is keeping competition (and thus price inflation) in check. Notably, policy decisions will play a role: the Alliance notes that how quickly interest rates fall and government policy changes like stamp duty will influence house price performance in 2025. If the Budget delivers a tax cut for most buyers, we might see a small boost to prices (as upfront costs drop) but also more transactions, which helps normalize the market. By contrast, a new tax on £500k+ sales could mainly affect London’s priciest segment (average London prices ~£565k), potentially limiting price growth at the top while leaving mid-market values steady.

House Price Growth Forecasts for 2025:

| Source | Forecast 2025 Price Change |

| HomeOwners Alliance | +2% (mid-year revision from 4% est.) |

| Nationwide Building Society | Up to +4% (higher-end optimistic case) |

| Rightmove (listing portal) | +2% (revised down from 4% mid-2025) |

| Capital Economics | +2.0% (year to Q4 2025) |

As for property transactions, many observers say the current lull is a “wait and see” pause ahead of the Budget. Would-be buyers and sellers have been sitting tight due to uncertainty over taxes and interest rates. Indeed, surveys show over half of homeowners are concerned about stamp duty or financing costs when considering a move. This pent-up demand suggests that once policy clarity emerges, the market could see a release of activity. Historically, housing activity often rebounds once uncertainty lifts, with side-lined buyers jumping in and sellers who had delayed listing finally coming forward. We already see hints of this: new property listings in September 2025 jumped 19% versus August, indicating sellers are preparing for post-Budget movement. Should the Budget cut transaction costs (e.g. stamp duty relief), expect a further surge in sales volume – a welcome change after the subdued levels of 2023–24. The Office for Budget Responsibility likewise projects property transactions and related tax receipts to recover from 2024–25 onwards, after the downturn caused by recent rate hikes and the end of 2021’s stamp duty holiday.

Mortgage Rates and Financial Climate

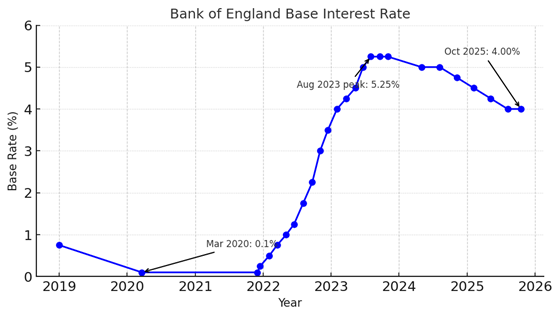

Bank of England base interest rate (%), 2019–2025. After steep hikes in 2022–23 to a peak of 5.25%, rates have begun to decline, standing at 4.0% in late 2025. Forecasts anticipate further gradual rate cuts through 2026 as inflation comes under control.

The financial backdrop for housing is defined by interest rates, which surged over the past two years and have only recently begun to ease. The Bank of England’s base rate, which influences mortgage costs, climbed from near 0% in 2021 to about 5.25% by August 2023 – a 15-year high – before subsequently edging down to 4.00% by late 2025. This spike translated into much higher mortgage rates, squeezing affordability for buyers. Fortunately, with inflation finally cooling, the Bank of England has started cutting rates. Analysts expect the Bank Rate will continue to be trimmed in 2025 and 2026 (possibly reaching ~3.5% by mid-2026) as price growth returns to target. In the near term, interest rates remain “restrictive” and the MPC is cautious about large cuts – meaning mortgage rates likely won’t plummet overnight. But the direction of travel is positive for borrowers. Many homeowners coming off fixed-rate deals in 2025 should see slightly lower offers than they would have a year prior, and new buyers may find mortgage quotes a bit less punishing than the 6%+ highs of 2023.

The Autumn Budget can indirectly influence this rate environment. If the Budget demonstrates fiscal discipline and credible deficit reduction (filling that ~£50 billion “black hole”), it could bolster investor confidence, keeping UK bond yields stable or falling. That, in turn, helps keep mortgage rates on a downward path. A good example was the fallout from 2022’s mini-budget: an unfunded tax-cutting spree spooked markets and caused a bond yield spike, which drove up mortgage costs. The 2025 Budget is unlikely to repeat that mistake – rather, it aims to reassure markets. A balanced, no-surprises budget should support the Bank of England’s efforts to lower rates, easing the financial pressure on the housing market. On the other hand, any upside surprises for the economy (e.g. better growth or the government’s touted planning reforms adding £6.8 billion to GDP) could also be a boon: stronger growth with falling inflation is the ideal scenario, fostering a stable or improving jobs outlook that makes both lenders and borrowers more confident.

Investor Reactions and Market Sentiment

Property investors and landlords will be watching this Budget closely. In recent years, landlords have been hit by higher taxes (for instance, an extra 3% SDLT surcharge on second homes, which Reeves even raised to 5% in 2024) and reduced mortgage interest relief. If the mooted stamp duty changes go ahead, investors may not enjoy the same tax relief as owner-occupiers – the proposal is to abolish SDLT on main residences only, meaning buy-to-let purchases would still pay the old tax. This differential could further tilt the market towards first-time buyers, a deliberate policy choice to help “working people” over speculators. Some landlords might accelerate plans to sell if rental profits are squeezed by tax changes (there’s even speculation about charging National Insurance on rental income or other measures to equalize landlord taxes). Such moves, while a risk for the rental supply in the short run, could free up housing stock for purchase, softening prices and benefiting prospective owner-occupiers. Property investors, then, face a mixed bag: higher transaction and holding costs on one side, but potentially a more stable market (with serious homebuyer demand) on the other. Those invested in high-end property might be warier – a new levy on £500k+ home sales or a CGT “mansion tax” would directly hit returns for that segment, perhaps prompting some to shift focus to lower-value regions or alternative assets.

In terms of broader market sentiment, the Budget’s impact will extend beyond real estate. Financial professionals note that a credible fiscal plan can improve the UK’s risk profile, attracting investment and strengthening the pound – all of which create a healthier economic backdrop for property. Conversely, if the Budget disappoints (say, by under-delivering on growth or fairness), it could dampen confidence. So far, signals are optimistic: the government’s comprehensive housing reforms (announced ahead of the Budget) – including speeding up transactions with digitalization and binding contracts – have been welcomed as long-needed modernization. These reforms, combined with clarity after the Budget, could inject a sense of momentum into the property sector. Market analysts often remind us that real estate sentiment can turn on a dime: a few months of improved inflation, lower rates, and supportive policy news can swing the mood from caution to confidence. If Budget 2025 delivers reforms that are seen as pro-growth yet fiscally sound, it may encourage investors (domestic and overseas) to re-engage with UK property – whether that’s developers investing in new projects, or buyers feeling it’s “safe” again to make that big purchase. In short, the Budget has the chance to reset expectations positively, mitigating some risks that have kept activity subdued.

This pie chart shows how homeowners and buyers are feeling ahead of the 2025 UK Budget:

🟦 55% – Waiting for Budget clarity

🟩 30% – Ready to buy

🟧 15% – Planning to sell soon

This reflects a market still in “pause mode” — with most participants holding off major moves until post-Budget announcements confirm tax and mortgage policy.

Conclusion

The Autumn Budget 2025 stands to be a pivotal moment for UK property and finance. It arrives at a time when the housing market is fundamentally stable but craving a catalyst to overcome recent sluggishness. By addressing stamp duty and other outdated taxes, the government could reduce barriers for buyers and inject new energy into property transactions. Homeowners and first-time buyers are likely to benefit from any tax relief or support for affordability – for example, saving potentially thousands in SDLT and seeing slightly cheaper mortgages as interest rates ease. Investors and landlords may face some challenges (e.g. higher taxes on certain transactions or rental income), but they could also gain from a more efficient, transparent market and the long-term economic boost of reforms. The wider financial market should take comfort if the Budget balances fiscal responsibility with growth initiatives, as this paves the way for lower inflation and interest rates – a win-win for the economy and housing.

Ultimately, the property sector’s reaction will hinge on the fine print: how bold the stamp duty overhaul is, what offsets are introduced, and how these policies are phased in. A well-calibrated Budget could unlock pent-up demand and mark the start of a healthier cycle for housing in 2025, with increased activity and slowly rising prices that reflect improved confidence. However, stakeholders should stay prepared for adjustments – for instance, high-end homeowners may need to factor in new taxes when planning a sale, and landlords might revisit their portfolios in light of any tax changes. For now, a sense of cautious optimism prevails. After a period of uncertainty, clarity is on the horizon. If you’re a buyer or seller who has been on the fence, the message is: pay close attention to the Budget announcements on November 26 – they will likely bring opportunities. With sound planning and advice, homeowners, buyers, and investors alike can position themselves to take advantage of the new landscape that Budget 2025 will shape, turning the page to a more dynamic (and hopefully more equitable) property market.

Sources: Property Expert Advice & Support – HomeOwners Alliance / www.mortgagesolutions.co.uk / www.instituteforgovernment.org.uk/ / www.alexandersgroup.co.uk/ / https://ifs.org.uk/