June 30th, 2023.

What is Land Banking?

Land banking is when a developer purchases a plot of land, with the intention to develop at a later stage. In that time, the purchased land is said to be in their ‘land bank’, hence the term land banking.

Housebuilders often take part in this type of acquisition, where they can hold the land for as little as a year, or as long as several decades. The land can be left unused, or it can be used for a temporary purpose, such as a car park.

Why Developers ‘Bank’ Land

The first reason, as you may expect, is for investment purposes. Speculating whether the land, over time, will go up in value and yield a return for the buyer, is the motive here – because, let’s face it, it usually will.

A second reason is to strategically outmanoeuvre and blockade potential competition. An example would be housebuilders banking land in a particular area, preventing other housebuilders from buying and developing on the land.

Another reason could be, it’s used as a tool to push up the prices of land/property in an area. If you were to have high demand for homes in an area without the supply, as the land is already banked, it’s likely the value will increase. Then, the banker would reap the rewards if and when they decide to develop or sell off the land.

Land banking is used by developers to ensure a consistent pipeline, as well as to balance the supply and demand.

There is also the fact that a development firm aren’t able to develop the land right away, due to issues sourcing building materials, labour or funds (we help a lot of developers out at this stage – see our development exit page here).

Another consideration is delays with planning. Anyone who has had to deal with council planning departments or the Land Registry recently will know of how long things can take. In a situation where years have passed between purchase and getting the necessary permissions, the land is stagnant during this time.

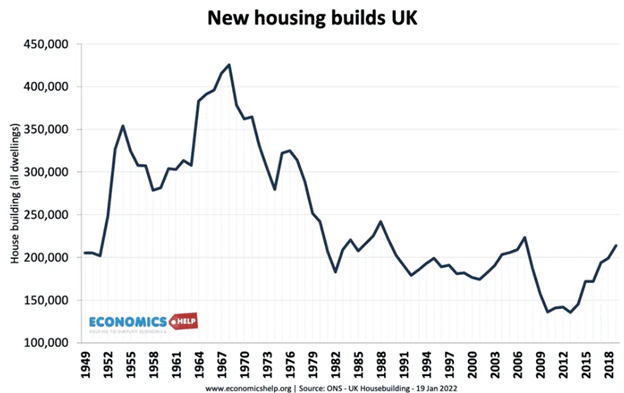

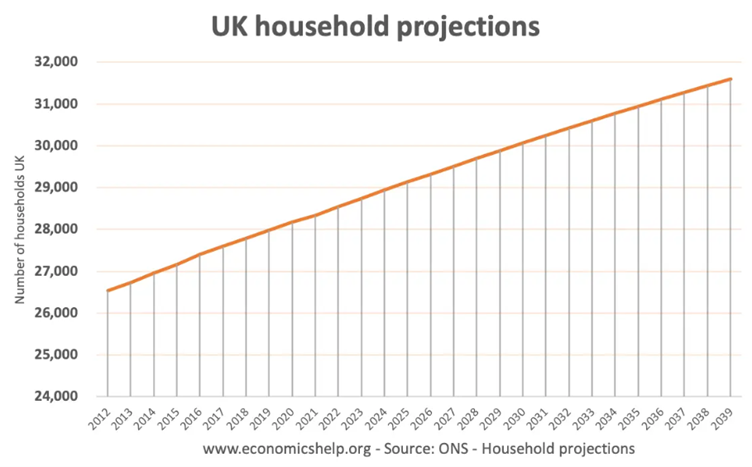

Graph demonstrating the rate of new house building year on year, against the rate of growing households

Pros & Cons of Land Banking

There are different schools of thought in regards to banking, and your position will likely depend on your industry and previous experiences.

As we’ve already touched upon earlier, the act of land banking is seen as a contributing factor to the housing crisis, as it takes away the supply issue. This is undoubtedly true, though the biggest question becomes, to what extent is land being banked intentionally.

The other side of the coin, again touched upon earlier, is that developers need a steady stream of developments, and that the pipeline is not designed for market manipulation, but is just a required step.

In it, he talks of the issues in the time it takes to build a new housing development, and how this contributes to prices increasing. The report concluded by Letwin saying he didn’t think land banking was an intentional cog in the business model of large housing developers, but it was the rate at which homes were built and sold that was the main issue.

What the future looks like

Though land banking is currently legal, there have certainly been calls to ban it. Others stated there should be a ‘use it or lose it’ policy, giving developers a definitive timeline to build on.

The government suggested changes to the current planning system, splitting land grades up into those that need planning permission and those that don’t.

Having a tax or levy was another idea put forward, aimed at encouraging the process to be sped up on areas that could have feasibly been built on.

Options currently available

Option Agreement

A developer and a landowner can establish an Option Agreement, granting the developer the choice to buy the land (typically at an agreed amount or at market price with predetermined deductions) and the ability to secure planning permission, while avoiding the risk of being obligated to acquire land without planning benefits.

Opting for an Option Agreement can also be advantageous for landowners, as it allows them to fetch a higher price for their land without the need to invest their own funds in obtaining planning permission.

Joint Venture with the Landowner

In a joint venture, the landowner and developer come together in an agreement where the landowner provides the land, while the developer may provide financial resources, project management expertise, or both.

The resulting profits are distributed based on a pre-established rate outlined in the joint venture agreement. Additionally, architects and necessary consultants may also join the joint venture, offering their services and being reimbursed once the project concludes and profits are realized.

Land bank tax

As we touched upon earlier, another option would be to introduce a new land tax structure. This could include paying a yearly tax, as opposed to just paying a sum when you purchase.

How can Pure structured finance assist?

Over the years, we have provided finance on all types of land at different positions in their planning journey. We can structure debt against the value of the site rather than the purchase price – in some cases, up to 90-100%. If planning has been gained prior to purchase via an option or exchange, again, we can use the uplifted residual value of the site. We work with all types of funders, so know whose criteria will best fit your needs.

To talk through all options on land or development finance, call us 02080 381 791, or request a call back here.